—————

Free Secure Email – Transcom Sigma

Boost Inflight Internet

Transcom Hosting

Transcom Premium Domains

News

Scalper Bots Fueling DVSA Driving Test Black Market

—————

Free Secure Email – Transcom Sigma

Boost Inflight Internet

Transcom Hosting

Transcom Premium Domains

Chaos Reigns as MITRE Set to Cease CVE and CWE Operations

—————

Free Secure Email – Transcom Sigma

Boost Inflight Internet

Transcom Hosting

Transcom Premium Domains

Sophos India Volunteers Bring Color to Local Schools

—————

Free Secure Email – Transcom Sigma

Boost Inflight Internet

Transcom Hosting

Transcom Premium Domains

Sophos Annual Threat Report appendix: Most frequently encountered malware and abused software

—————

Free Secure Email – Transcom Sigma

Boost Inflight Internet

Transcom Hosting

Transcom Premium Domains

The Sophos Annual Threat Report: Cybercrime on Main Street 2025

—————

Free Secure Email – Transcom Sigma

Boost Inflight Internet

Transcom Hosting

Transcom Premium Domains

CVE Program Almost Unfunded

Mitre’s CVE’s program—which provides common naming and other informational resources about cybersecurity vulnerabilities—was about to be cancelled, as the US Department of Homeland Security failed to renew the contact. It was funded for eleven more months at the last minute.

This is a big deal. The CVE program is one of those pieces of common infrastructure that everyone benefits from. Losing it will bring us back to a world where there’s no single way to talk about vulnerabilities. It’s kind of crazy to think that the US government might damage its own security in this way—but I suppose no crazier than any of the other ways the US is working against its own interests right now.

Sasha Romanosky, senior policy researcher at the Rand Corporation, branded the end to the CVE program as “tragic,” a sentiment echoed by many cybersecurity and CVE experts reached for comment.

“CVE naming and assignment to software packages and versions are the foundation upon which the software vulnerability ecosystem is based,” Romanosky said. “Without it, we can’t track newly discovered vulnerabilities. We can’t score their severity or predict their exploitation. And we certainly wouldn’t be able to make the best decisions regarding patching them.”

Ben Edwards, principal research scientist at Bitsight, told CSO, “My reaction is sadness and disappointment. This is a valuable resource that should absolutely be funded, and not renewing the contract is a mistake.”

He added “I am hopeful any interruption is brief and that if the contract fails to be renewed, other stakeholders within the ecosystem can pick up where MITRE left off. The federated framework and openness of the system make this possible, but it’ll be a rocky road if operations do need to shift to another entity.”

More similar quotes in the article.

My guess is that we will somehow figure out how to transition this program to continue without the US government. It’s too important to be at risk.

EDITED TO ADD: Another good article.

—————

Free Secure Email – Transcom Sigma

Boost Inflight Internet

Transcom Hosting

Transcom Premium Domains

Funding Expires for Key Cyber Vulnerability Database

A critical resource that cybersecurity professionals worldwide rely on to identify, mitigate and fix security vulnerabilities in software and hardware is in danger of breaking down. The federally funded, non-profit research and development organization MITRE warned today that its contract to maintain the Common Vulnerabilities and Exposures (CVE) program — which is traditionally funded each year by the Department of Homeland Security — expires on April 16.

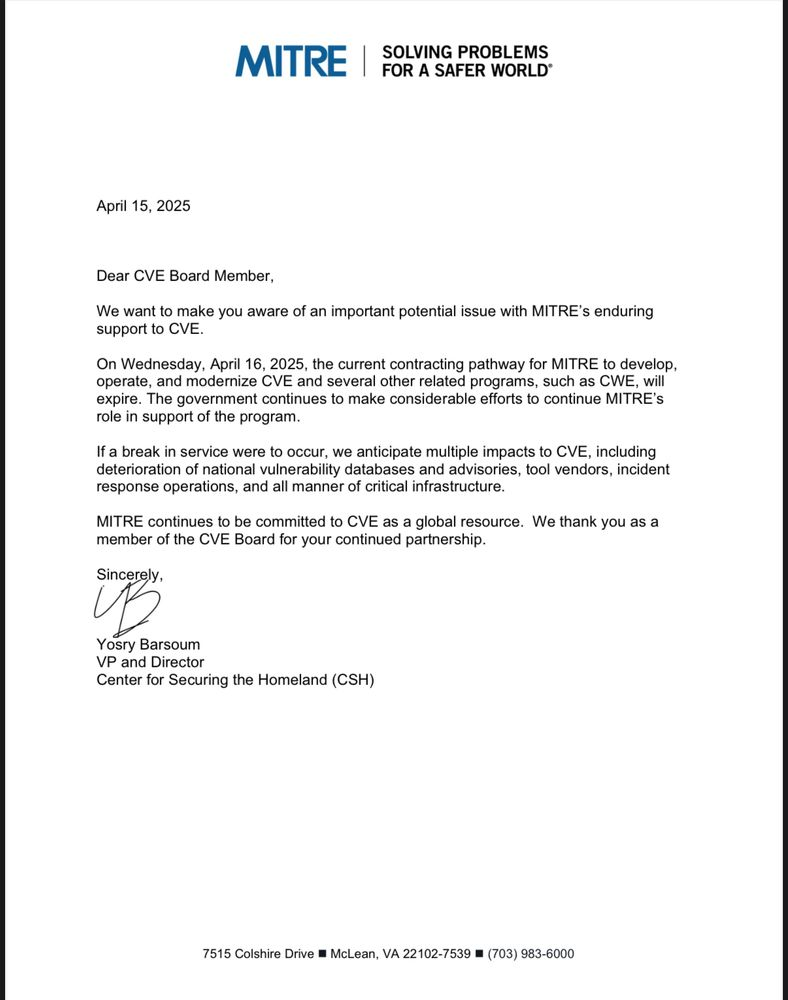

A letter from MITRE vice president Yosry Barsoum, warning that the funding for the CVE program will expire on April 16, 2025.

Tens of thousands of security flaws in software are found and reported every year, and these vulnerabilities are eventually assigned their own unique CVE tracking number (e.g. CVE-2024-43573, which is a Microsoft Windows bug that Redmond patched last year).

There are hundreds of organizations — known as CVE Numbering Authorities (CNAs) — that are authorized by MITRE to bestow these CVE numbers on newly reported flaws. Many of these CNAs are country and government-specific, or tied to individual software vendors or vulnerability disclosure platforms (a.k.a. bug bounty programs).

Put simply, MITRE is a critical, widely-used resource for centralizing and standardizing information on software vulnerabilities. That means the pipeline of information it supplies is plugged into an array of cybersecurity tools and services that help organizations identify and patch security holes — ideally before malware or malcontents can wriggle through them.

“What the CVE lists really provide is a standardized way to describe the severity of that defect, and a centralized repository listing which versions of which products are defective and need to be updated,” said Matt Tait, chief operating officer of Corellium, a cybersecurity firm that sells phone-virtualization software for finding security flaws.

In a letter sent today to the CVE board, MITRE Vice President Yosry Barsoum warned that on April 16, 2025, “the current contracting pathway for MITRE to develop, operate and modernize CVE and several other related programs will expire.”

“If a break in service were to occur, we anticipate multiple impacts to CVE, including deterioration of national vulnerability databases and advisories, tool vendors, incident response operations, and all manner of critical infrastructure,” Barsoum wrote.

MITRE told KrebsOnSecurity the CVE website listing vulnerabilities will remain up after the funding expires, but that new CVEs won’t be added after April 16.

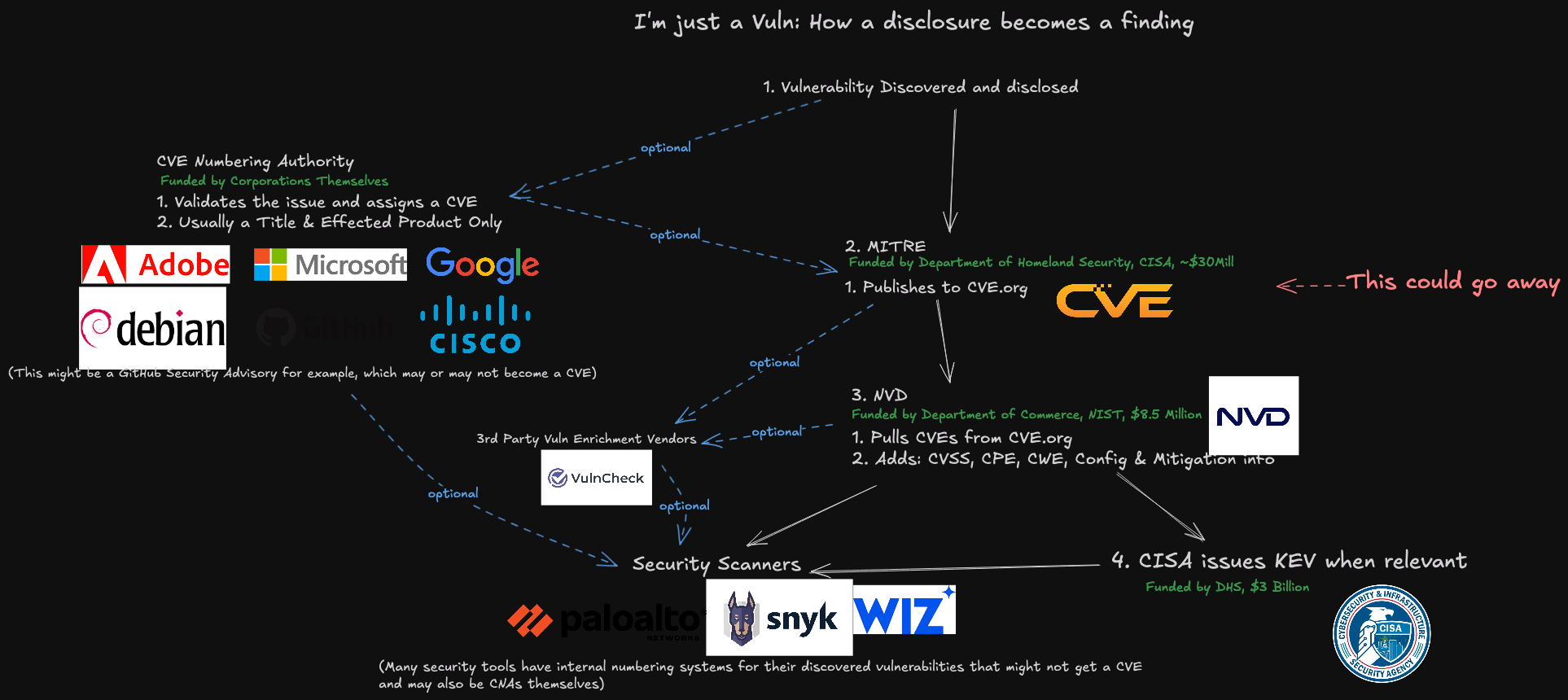

A representation of how a vulnerability becomes a CVE, and how that information is consumed. Image: James Berthoty, Latio Tech, via LinkedIn.

DHS officials did not immediately respond to a request for comment. The program is funded through DHS’s Cybersecurity & Infrastructure Security Agency (CISA), which is currently facing deep budget and staffing cuts by the Trump administration. The CVE contract available at USAspending.gov says the project was awarded approximately $40 million last year.

Former CISA Director Jen Easterly said the CVE program is a bit like the Dewey Decimal System, but for cybersecurity.

“It’s the global catalog that helps everyone—security teams, software vendors, researchers, governments—organize and talk about vulnerabilities using the same reference system,” Easterly said in a post on LinkedIn. “Without it, everyone is using a different catalog or no catalog at all, no one knows if they’re talking about the same problem, defenders waste precious time figuring out what’s wrong, and worst of all, threat actors take advantage of the confusion.”

John Hammond, principal security researcher at the managed security firm Huntress, told Reuters he swore out loud when he heard the news that CVE’s funding was in jeopardy, and that losing the CVE program would be like losing “the language and lingo we used to address problems in cybersecurity.”

“I really can’t help but think this is just going to hurt,” said Hammond, who posted a Youtube video to vent about the situation and alert others.

Several people close to the matter told KrebsOnSecurity this is not the first time the CVE program’s budget has been left in funding limbo until the last minute. Barsoum’s letter, which was apparently leaked, sounded a hopeful note, saying the government is making “considerable efforts to continue MITRE’s role in support of the program.”

Tait said that without the CVE program, risk managers inside companies would need to continuously monitor many other places for information about new vulnerabilities that may jeopardize the security of their IT networks. Meaning, it may become more common that software updates get mis-prioritized, with companies having hackable software deployed for longer than they otherwise would, he said.

“Hopefully they will resolve this, but otherwise the list will rapidly fall out of date and stop being useful,” he said.

Update, April 16, 11:00 a.m. ET: The CVE board today announced the creation of non-profit entity called The CVE Foundation that will continue the program’s work under a new, unspecified funding mechanism and organizational structure.

“Since its inception, the CVE Program has operated as a U.S. government-funded initiative, with oversight and management provided under contract,” the press release reads. “While this structure has supported the program’s growth, it has also raised longstanding concerns among members of the CVE Board about the sustainability and neutrality of a globally relied-upon resource being tied to a single government sponsor.”

The organization’s website, thecvefoundation.org, is less than a day old and currently hosts no content other than the press release heralding its creation. The announcement said the foundation would release more information about its structure and transition planning in the coming days.

Update, April 16, 4:26 p.m. ET: MITRE issued a statement today saying it “identified incremental funding to keep the programs operational. We appreciate the overwhelming support for these programs that have been expressed by the global cyber community, industry and government over the last 24 hours. The government continues to make considerable efforts to support MITRE’s role in the program and MITRE remains committed to CVE and CWE as global resources.”

—————

Free Secure Email – Transcom Sigma

Boost Inflight Internet

Transcom Hosting

Transcom Premium Domains

North Korean Hackers Exploit LinkedIn to Infect Crypto Developers with Infostealers

—————

Free Secure Email – Transcom Sigma

Boost Inflight Internet

Transcom Hosting

Transcom Premium Domains

Compliance Now Biggest Cyber Challenge for UK Financial Services

—————

Free Secure Email – Transcom Sigma

Boost Inflight Internet

Transcom Hosting

Transcom Premium Domains